Granlund’s annual report 2022

Granlund’s annual report provides an overview of the Group’s key events from 2022. Read more about Granlund’s growth, business, innovations and sustainability.

CEO’s market analysis

The year 2022 began positively, and normal life was expected to resume after two years of COVID-19. We got to enjoy two months of normal life. Then Russia started its war of aggression in Ukraine. We could forget about business getting back to normal. The world quickly discovered that surprisingly many raw materials, parts of supply chains and business operations were, in one way or another, linked to Russia or Ukraine, which posed immediate challenges.

The connections to Russia were realised, especially in the energy sector, which saw the most dramatic year since the oil crisis. And so, the rise of the stock market stopped early in the year, and financial insecurity was increased by the sharp inflation late in the year combined with the interest rate market returning to its normal level. In the real estate and construction industry, the situation was laid bare by growing maintenance costs and an eagerness to save energy. The market saw fierce competition between expert-, contractor- and system provider-driven operating models, and new service models and investment solutions entered the market.

The order books of consultants returned to the normal level, and even some major projects were completed, even though their proceeds were shared by fewer companies with the market showing clear signs of polarisation. Many listed consulting firms felt the full brunt of the unforgiving stock market, and experts voted with their feet against major changes. Overall, staff turnover in the sector remained at the high level of the COVID-19 years.

Technical building service engineering was typified by energy renovations, and lifecycle schools and renovation projects were also carried out at a rapid rate. Technical building service experts were also kept busy designing hospitals and data centres.

As in the previous year, the sector’s strong themes included ESG goals as a sign of overall sustainability. However, environmental certification entered a deeper level signified by carbon neutrality roadmaps, for example. In addition, projects involved a higher level of calculated and data-based analysis, which requires efficient data flow, integrations and standardised calculation models.

On the data side, concrete development steps were expected during the year in e-commerce and integrated calculation models, for example. The aim is to standardise the flow of data. In the foreseeable future, we will surely see more standardised operating models that use an automated data flow to reduce manual labour and improve scheduling, cost estimates, life cycle analysis and management of the situation picture, both on sites and in properties.

When it comes to real estate and construction software, the Finnish market leaders retained their position and significant system swaps took place, especially in the public sector. That said, in terms of the operating environment, the landscape in the Nordic countries is shifting, which may mark the end of the period of so-called hyper economy. On the software market, the software business has a slower effect than the developing integration business. The need to transfer data between different software is growing, which is also in evidence in the diverse real estate industry. Different functions select the software best suited to them, using various data transfer platforms and interfaces to ensure integration between them.

Business Finland actively funded R&D projects. At the same time, there was fierce competition for research financing for EU projects. The most important areas of R&D included hospital design, energy-efficient solutions and the utilisation of artificial intelligence. A delightful first step was the launch of the MEP 2030 (Talotekniikka 2030) programme. Leading companies and educational institutions in the sector took their cue for cooperation from the Building 2030 programme and collected funding for research.

The need to transfer data between different software is also evident in the construction industry.

Key figures

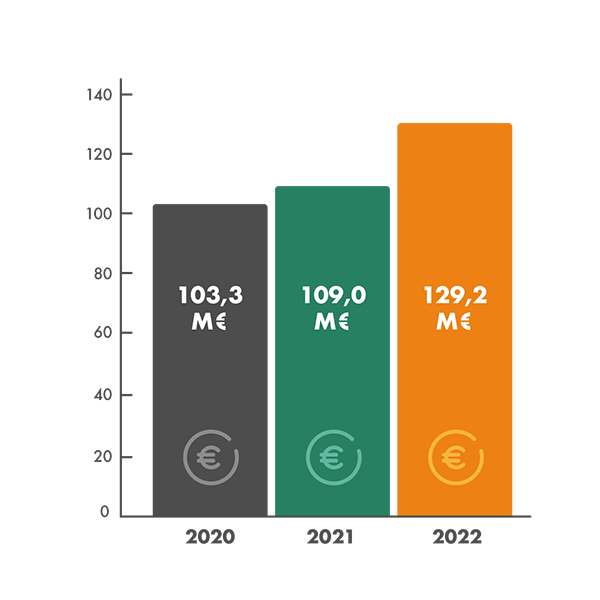

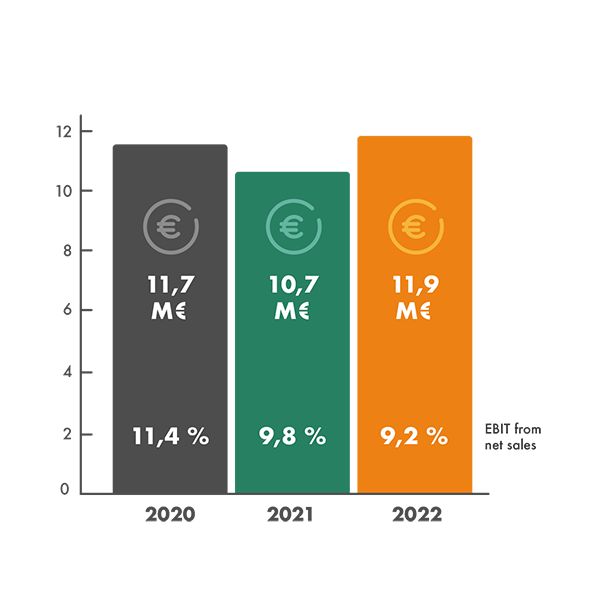

Granlund Group made a profit in 2022, and the company’s solvency and liquidity remained good.

By and large, the net sales and operational results of the Group companies were at a good or satisfactory level. Granlund Facility Management was the only one to make a loss.

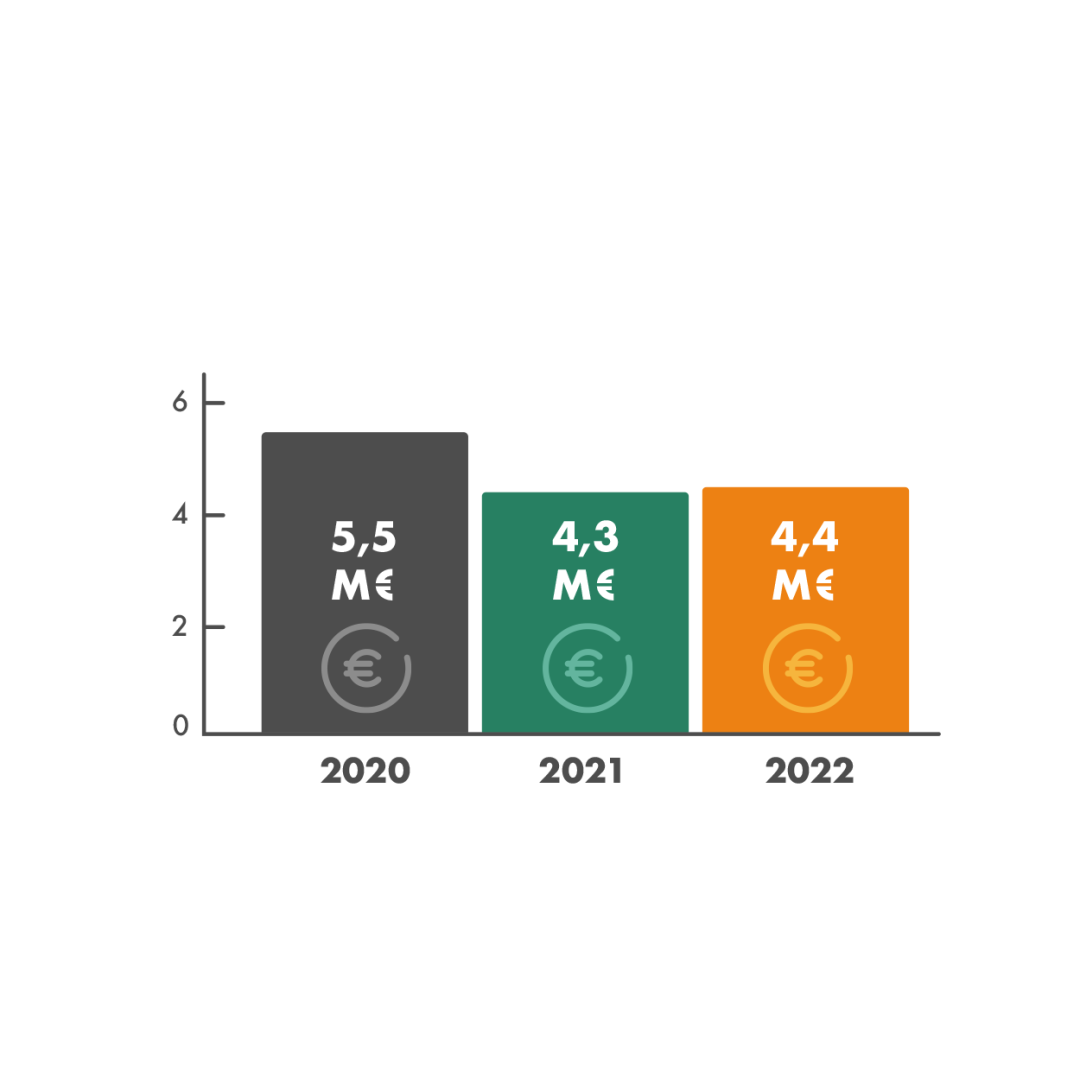

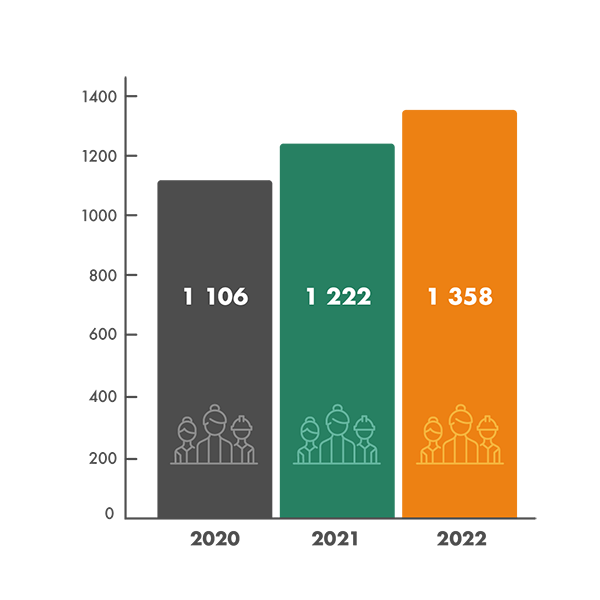

The Group’s net sales increased by 18.5% year-on-year to EUR 129.2 million. The gross margin increased year-on-year to EUR 17.2 million. Approximately EUR 4.4 million in total was paid out to the personnel in profit-related bonuses.

The Group’s operations remained profitable, and net sales increased.

Changes in the Group structure

In 2022, Granlund Group implemented six acquisitions, all of which took place early in the year.

Our activity in acquisitions was also visible in the 2022 growth figures. The new net sales arising from acquisitions amounted to over EUR 11 million (2021–2022).

To support our project business, we have also acquired new cost calculation and digital scheduling services, for example. Our company in China ceased its operations during the year.

In 2022, the Granlund family was joined by six companies

- Electrical design specialists Eco Konsult i Stockholm AB (Granlund Stockholm AB)

- HVAC technology quantity and cost calculation specialists Vesi & Watti Oy (Granlund Oy)

- 4D scheduling service specialists Lean4D Oy and its partners (Granlund Oy)

- The established electrical design company from Forssa in southern Finland, Macel Oy (Granlund Häme Oy)

- LVI-suunnittelu Ismo Heinonen Oy (Granlund Kuopio Oy), which has operated in Varkaus in eastern Finland for more than 30 years

- Rakennuskonsultointi K-suunnittelu Oy (Granlund Mikkeli Oy), which has operated in Mikkeli in eastern Finland for nearly 50 years.

Strategy

Launched in 2020, Granlund’s Plan G strategy continued to be implemented in 2022. Although there were no significant changes in direction, a new project was designed to raise the profile of MEP engineering. It got off to a flying start with the kick-off of the MEP 2030 (Talotekniikka 2030) programme and the launch of the MEP NEXT (Talotekniikka NEXT) event.

Granlund Group’s growth made a strong return in 2022 at over 18%. In accordance with our Plan G strategy, our growth is driven by acquisitions, data centre and energy services, comprehensive renovation services as well as continuing customerships. We also took positive steps with new service models in maintenance, property management and the implementation of MEP engineering, which will be visible in our operations in the next few years.

In the future, our new central data development unit will offer better data flow support to our different business segments, improve our services and create new data-based solutions for our customers. It will take time to make all of our services data-based, but the direction is already clear. Data in a specified form reduces manual work, makes it possible to use the same data in many different services and creates a real-time situation picture of projects. Good examples of data use development include data-based scheduling services, cost estimates and carbon calculations. In the next few years, data will enable far greater improvements in productivity than ever before in the history of the real estate and construction industry.

The Board of Directors outlined preliminary scenarios regarding a global growth strategy that is stronger than our current strategy as well as the required arrangements. This conversation will be continued throughout 2023 with Granlund’s partners and all of our employees.

In 2022, we completed the first version of the strategic indicators demonstrating the progress of Plan G. They include M&A transactions, developing new services and increasing the net sales of continuous services.

Strategic project puts low-carbon construction on the designer’s desk

MEP engineering makes up a significant part of the climate impacts and emissions of construction. In our low-carbon design strategy project, sustainability consultants and designers work together to develop solutions that make low-carbon design a natural part of the design process.

The project produces concrete instructions on which systems and equipment produce the highest and lowest lifecycle emissions.

An important part of our strategy, sustainability informs the development of our operations. We want to lead the way in carbon neutrality and sustainability in the real estate and construction industry, both through our own activities and for the benefit of our customers.

In 2022, we clarified our sustainability programme to align with our mission. Our goal is to create well-being for people, buildings and the environment. These three themes constitute sections of Granlund’s sustainability reporting. You can read more about Granlund’s financial responsibility in the Customer and Key figures sections, for example. Our sustainability indicators are included in our strategic indicators.

Granlund’s sustainability programme: well-being for the environment, people and buildings

Well-being for the environment

We take the well-being of the environment into account in our own operations and customer work alike. We help our customers adapt to the impacts of climate change and reduce their carbon footprint throughout the lifecycle of the property.

In 2022, Granlund joined the Science Based Targets initiative, on the basis of which Granlund will set the science-based target to reduce the emissions of its operations by 1.5 degrees.

Well-being for people

When it comes to the well-being of people, we include both our employees and the users of premises. We want to develop the best possible workplace, which is why we started our diversity and inclusion work in 2022. You can read more about it in the Personnel section.

To ensure the well-being of the users of premises, we design sustainable, smart, healthy and safe premises, e.g. for schools, daycare centres, hospitals, museums and commercial properties. People feel well in buildings that are designed and maintained using sustainable and energy-efficient solutions. It creates well-being for communities and society alike. Read more about our research project to improve the conditions at hospitals.

Well-being for buildings

We ensure the well-being of buildings through proper design and maintenance. We use digital solutions and data to improve the energy efficiency of buildings, reduce material and energy waste, ensure good conditions and develop the use of properties.

Our goal is to promote the development of the real estate and construction industry as a whole, training and innovation, which is why our experts contribute to the development and research of the practices and standards used in the industry. Read more about subjects such as FIGBC’s Hiilineutraali rakennus (Carbon neutral building) instructions and the MEP 2030 programme.

Granlund’s carbon footprint

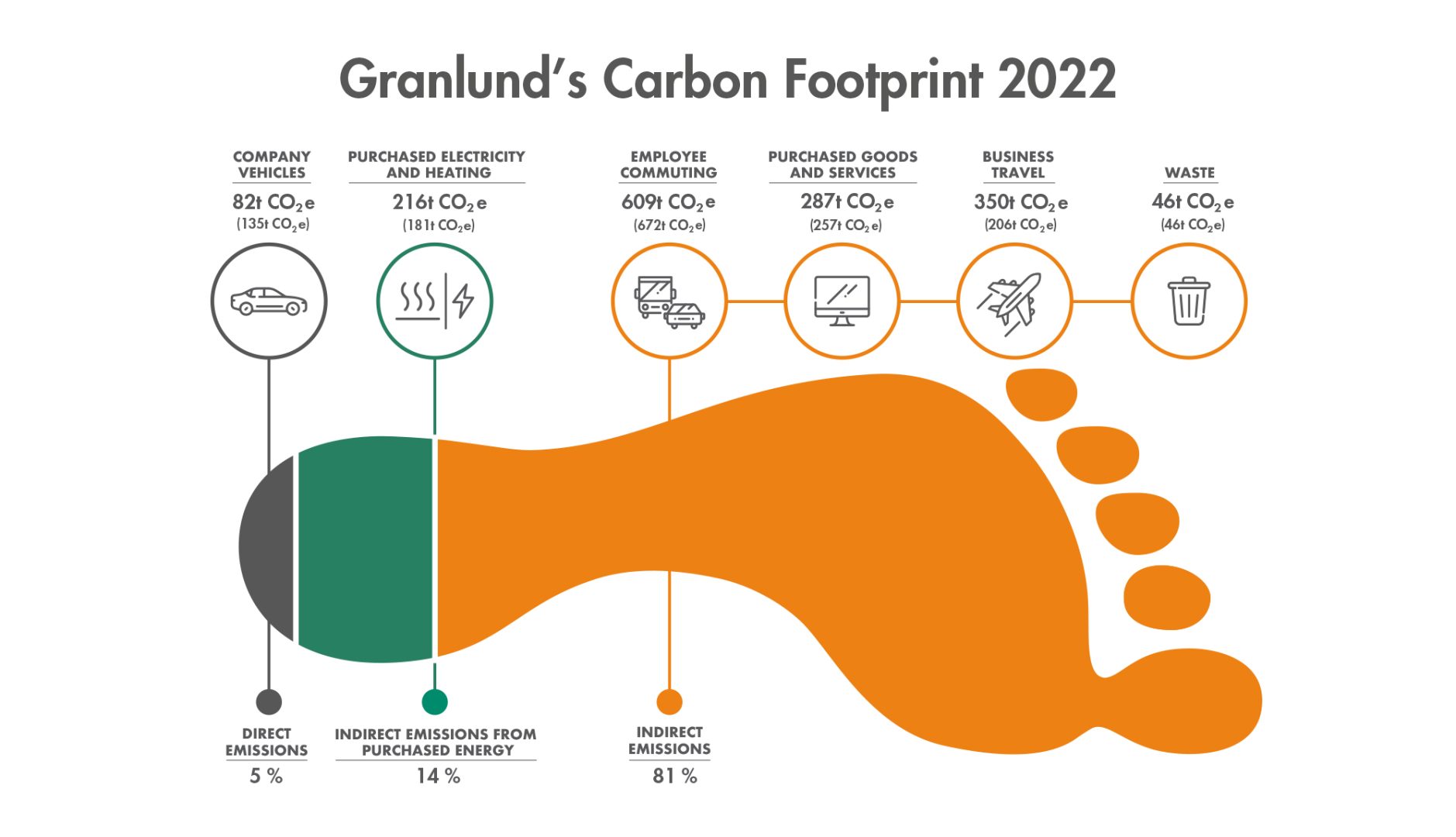

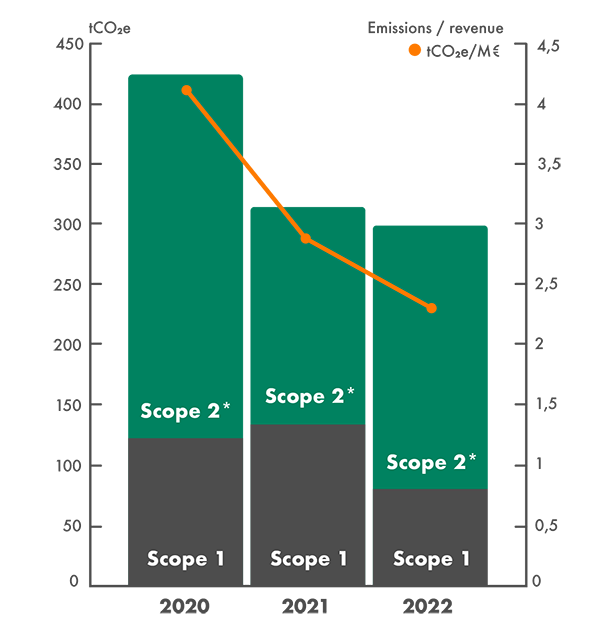

We calculate our carbon footprint according to the GHG protocol. The GHG protocol is an internationally acknowledged calculation standard that divides emissions into three scopes. Our calculation includes direct emissions (Scope 1), the indirect emissions of purchased energy (Scope 2) and other indirect emissions essential to Granlund (Scope 3).

The higher number of premises due to acquisitions as well as the return to offices resulted in an increase of our absolute Scope 2 emissions in 2022. Our Scope 1 emissions were reduced due to the lower emissions from company cars and zero refrigerant emissions. Consequently, the absolute Scope 1+2 emissions continued to decrease by 5%. Relative to the net sales, the Scope 1+2 emissions dropped by 20%.

*We report our Scope 2 emissions using a market-based calculation method that takes into account the specific emissions of the energy we purchase. In 2022, our location-based emissions arising from energy consumption were 518 tn CO2-eq. The figure is based on the average specific CO2 emissions of purchased electricity in Finland.

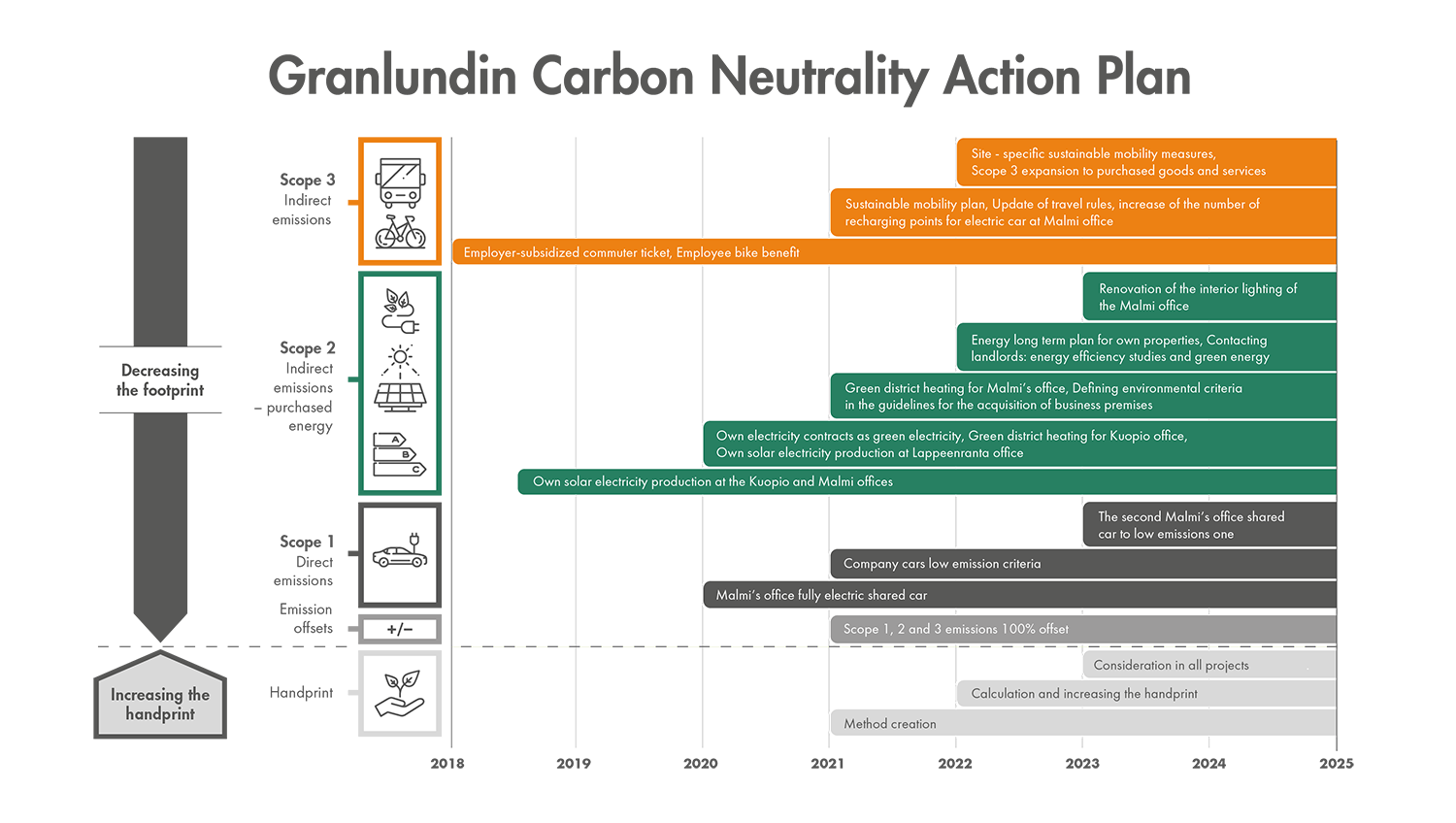

Carbon neutrality road map

We maintain the carbon neutrality of our own operations through systematic carbon neutrality work guided by the carbon neutrality road map. Concrete acts pertaining to our road map include using electricity produced by renewable wind power and green district heating in our own properties, for example. Many of our offices produce solar energy. To cut the resulting emissions, we support sustainable commuting by providing employee travel tickets and company bicycles. Our employees can also take advantage of the shared cars, bicycles, electric bicycles and electric scooters intended for travel during the working day.

In 2022, we looked into the energy-efficiency of the office facilities we rent in Finland as well as the use of renewable energies. We also offered our expertise to lessors to improve energy-efficiency.

Long-term energy-efficiency plans were drawn up for the properties owned by Granlund in Kuopio. On the basis of the plans, the pressure level of the domestic water network was reduced and lighting was renewed.

We monitor the positive climate effect of our customer work through the carbon handprint

Our goal is to measure the positive climate effect of our customer work through the carbon handprint . The groundwork for this goal was laid by a 2022 thesis mapping and assessing different calculation methods. We have determined a calculation method for our own carbon handprint and calculated the first carbon handprint for our customer’s energy-efficiency project.

We have also launched a dedicated strategic project to promote carbon neutrality and increase the carbon handprint.

According to our research, common practices are needed to determine the carbon handprint.

Business operations

MEP design and project business

From a sales point of view, 2022 was one of our best years ever. Of particular interest last year was Granlund’s ability to stand out as a design partner in important projects in Finland, which will also keep our experts busy in the years to come. The success of sales was based on long-term work with regular customers as well as Granlund’s strong know-how.

In the design and project operations, the key drivers for our customers include the energy-efficiency, cost-efficiency and efficient schedules of projects. Instead of just technical design, more and more customers are choosing us as their partner to steer the objectives of the project and manage the design and procurement processes. That is why we developed and piloted new commercial models in 2022. In the MEP engineering model, we take a greater deal of responsibility for the technical and commercial success of MEP engineering. We act as the project developer or developer’s partner who is committed to achieving the cost, quality, schedule and sustainability goals of MEP engineering in addition to design.

We also develop better operating models for project cost management on an ongoing basis. In addition, the dynamic information management and reporting model we developed for design projects has been welcomed by our partners and customers. The application improves different project parties’ ability to collaborate and transparency, regardless of the project form.

The year 2022 also saw a sharp increase in construction. Projects that have reached the construction stage are still few in number, but we have been chosen as an MEP engineering partner for several high construction projects that are still at the development stage. We have also managed to create new MEP engineering concepts for high construction that bring significant cost savings, challenge global competitors and help develop the whole sector.

In the design and project operations, the key drivers for our customers include the energy-efficiency, cost-efficiency and efficient schedules of projects.

The major projects in 2022 included:

• Laakso Hospital (City of Helsinki/HUS Kiinteistöt Oy)

• Renovation and extension of Lapland Central Hospital (Rovaniemi, the municipal consortium of the Hospital District of Lapland)

• Building F of the Oulu University Hospital (OYS Hospital of the Future, NCC Suomi Oy)

• Kuopio University Hospital

• Vaasa Central Hospital

• The office property on Metallimiehenkuja 6–8 (HGR Property Partners Oy)

• The office, laboratory and production facilities of the Nokia campus (Oulu, YIT Suomi Oy)

• The central tower of Pasila (Varma Mutual Pension Insurance Company)

• Silicon wafer factory (Okmetic Oy)

• Roihupelto campus (Lujatalo Oy)

Software business

In the software business, Granlund Manager achieved important victories in the maintenance and energy system sector as well as especially the public sector. The domestic order book is in excellent health, and we are expecting some major system decisions to take place early in 2023.

In 2022, our focus shifted to comprehensive digital life-cycle data management. Together, Granlund Manager and the equipment data software previously known as Granlund Designer form a unique comprehensive solution to satisfy the market needs now and in the future.

Our long-term work to develop Digital Twin and utilise data models in maintenance also resulted in several Digital Twin deliveries in Finland and abroad. There is clearly increasing interest in data management and using it to improve reporting.

There is also increasing interest in integrations and digital life-cycle data management. Integration solutions meet the customers’ business intelligence needs, and there was a record number of real property and software integration projects completed during the year. We will keep investing in the productisation of integrations. As an example, we have launched an ecosystem partnership scheme.

In our international software business, we specifically invested in partnerships in Sweden and continued our solid cooperation in the Baltic countries. In the Middle East, we retained and increased our current accounts, and an active partner of ours in India has made significant headway amongst the Western industrial companies in the region.

Loss of biodiversity entered the climate change debate.

Consulting

The acute energy crisis highlighted the importance of the long-term development of energy solutions. Demand for all of our energy, ESG and sustainability services increased, and loss of biodiversity entered the climate change debate. We actively continued to set carbon neutrality goals and draw up carbon road maps, and many of our customers invested in creating and implementing sustainability strategies. There was also increasing interest in EU taxonomy and forms of renewable energy.

During the year, the low-carbon requirements applicable to construction projects were evident in a growing interest within the companies operating in the construction sector to find out the emissions of their products. Consequently, we drew up EPD environmental declarations for several products. The net sales of energy-efficiency projects also experienced significant growth, with a high percentage of projects implemented as a project management service.

Continuous services became stronger and gained new customers. The previous year was also record-breaking for the Due Diligence activities associated with real estate transactions in Finland as well as the Nordic and Baltic countries. Residential properties and community properties were a source of special interest. Our consulting services in England focused on district heat and district cooling reports.

During the year, the project management service developed by us proved its worth, especially in energy-saving projects.

Building development and supervision

Our building development and renovation services significantly increased, employing over 100 experts by the end of the year. We offer project management as a stand-alone service or comprehensive service, in which case we carry the overall responsibility for reconstruction project management from the required design to research and expert services.

In the 2022 customer survey, building development received the best feedback from our customers. In implementations, we invest in customer-orientation. Wood construction clearly increased over the course of the year, and the low carbon requirements of buildings were in evidence in projects. The key customer groups included the public sector and major property owners.

During the year, the project management service developed by us proved its worth, especially in energy-saving projects. The new model was also successfully used for major MEP engineering implementations. In the project management service, we assume responsibility for the management of the entire project as well as procurement, which brings added value, specifically to renovation projects that are challenging from the MEP perspective, energy-efficiency projects and clean room projects.

Data centres

The year was busy for our data centre business, which saw some significant growth. Our existing customerships remained at a healthy level or increased. Data centre projects were mainly carried out in Finland and Sweden, where Granlund Sweden AB has already gained good visibility on the data centre market. The growth is also expected to continue in the other Nordic countries.

The data centre projects positively reflected the decision to cut the tax on data centres that utilise waste heat, which entered into force in Finland in early 2022. In accordance with our customers’ preferences, we can assume responsibility for the design of the data centre project as a whole and act as the project’s main consultant together with a reliable network of subcontractors.

The year was busy for our data centre business, which saw some significant growth.

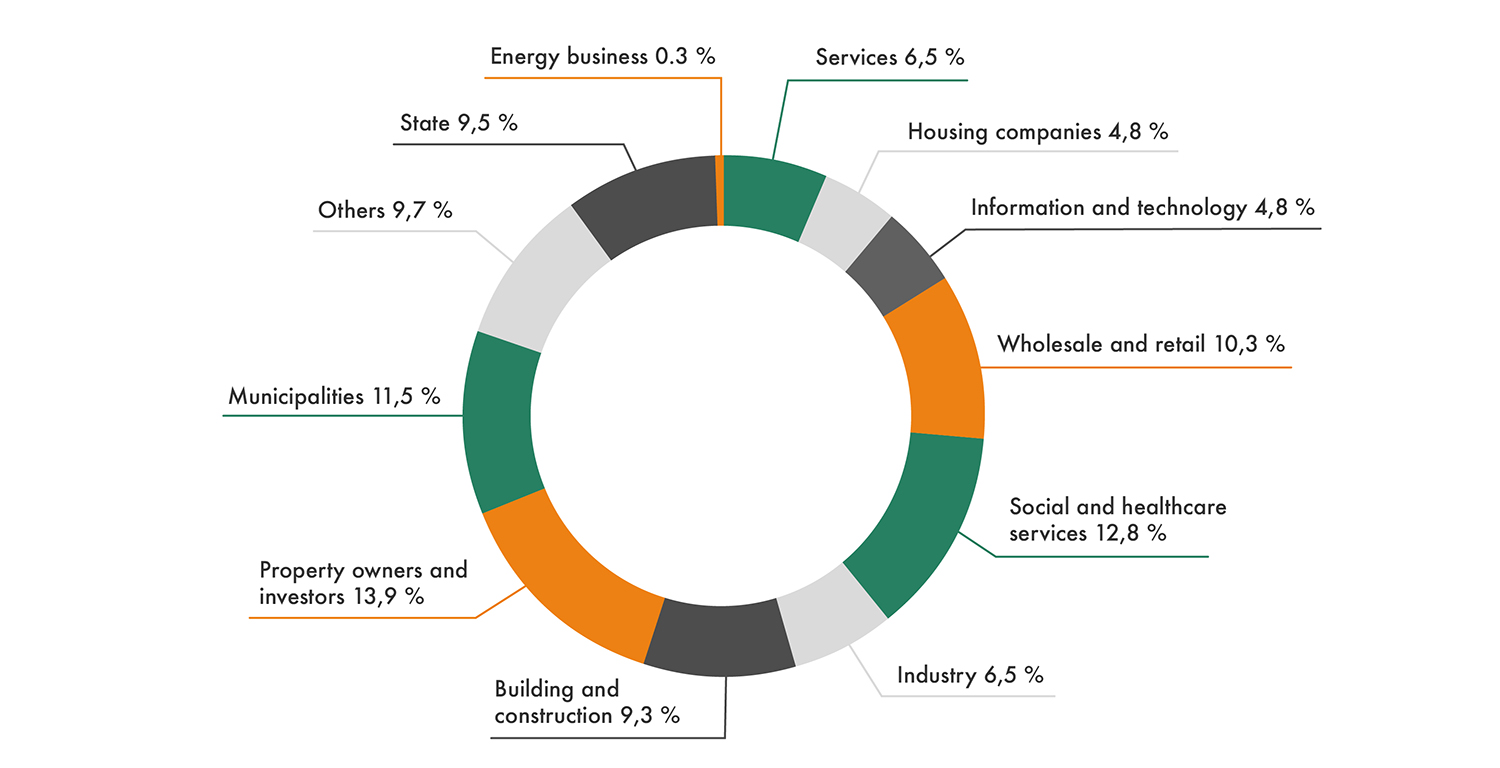

Our key customers

Special design

It was a busy year for design services related to special expertise. Our special expertise in areas such as lighting, AV and presentation technology, telecommunications and security technology, clean rooms, fire prevention technology, refrigeration technology, securing power distribution as well as kitchen design was exhaustively used both in our own projects and within the Group.

The most important projects in 2022 included the presentation technology, AV and lighting technology design for the renovation of the Finlandia Hall, renovation of the Finnish National Theatre and design of the ePower Hub of Aalto University. Special design was also required at Nokia’s new research and product development unit in Oulu, several logistics centres and hospitals as well as at the commissioning stage of West Metro. Our expertise is also trusted abroad. Thanks to our extensive know-how, we are able to meet the requirements of the most demanding customers and projects.

Granlund provides a comprehensive set of special design services for projects.

Architectural and structural design

The importance of our architectural and structural design services has increased, both in terms of our own assignments and joint projects with MEP Engineering. Often, architectural and structural design complements MEP design in renovation and alteration projects. Our more experienced architects are also kept busy by project development projects all the way from the town plan stage.

The collaboration between different design areas in projects is seamless, and the scope of the local offering has introduced new options to meet customers’ requirements. Our group of experts has become stronger, especially in the regions of Mikkeli and Granlund Saimaa in Eastern Finland.

Project development supports the scheduling, cost and sustainability goals of construction projects by digital means.

New services for construction projects

During the year, we bolstered our offering with new services that support a construction project throughout its different stages. A significant part of the new services is based on digital solutions and the better use of data in construction.

Our project development department expanded its operations in late 2022. Project development supports the scheduling, cost and sustainability goals of construction projects by digital means. Our new project management services include, e.g. data model-based 4D scheduling, HEPAC calculation registers as well as the quantity surveying and cost calculation of HEPAC technologies.

The department’s aim is to put together all of our property development know-how. More than 50 quantity surveying and 4D scheduling experts specialise in MEP engineering consulting at early project stages as well as steering the customer’s goals throughout the entire construction project. We produce reliable data-based estimates to help control the project’s quality, costs and schedules.

Facility management

For Granlund Facility management, 2022 was the second whole year of operation. Even though Granlund managed to increase the volume through new customer contracts, we still faced some profitability challenges during the year. We continued to remodel our service processes, developed the facility management team model and strengthened our technical facility management service offering. The accounting services of customer corporations were outsourced and the company’s business premises and customer service organisation were reorganised.

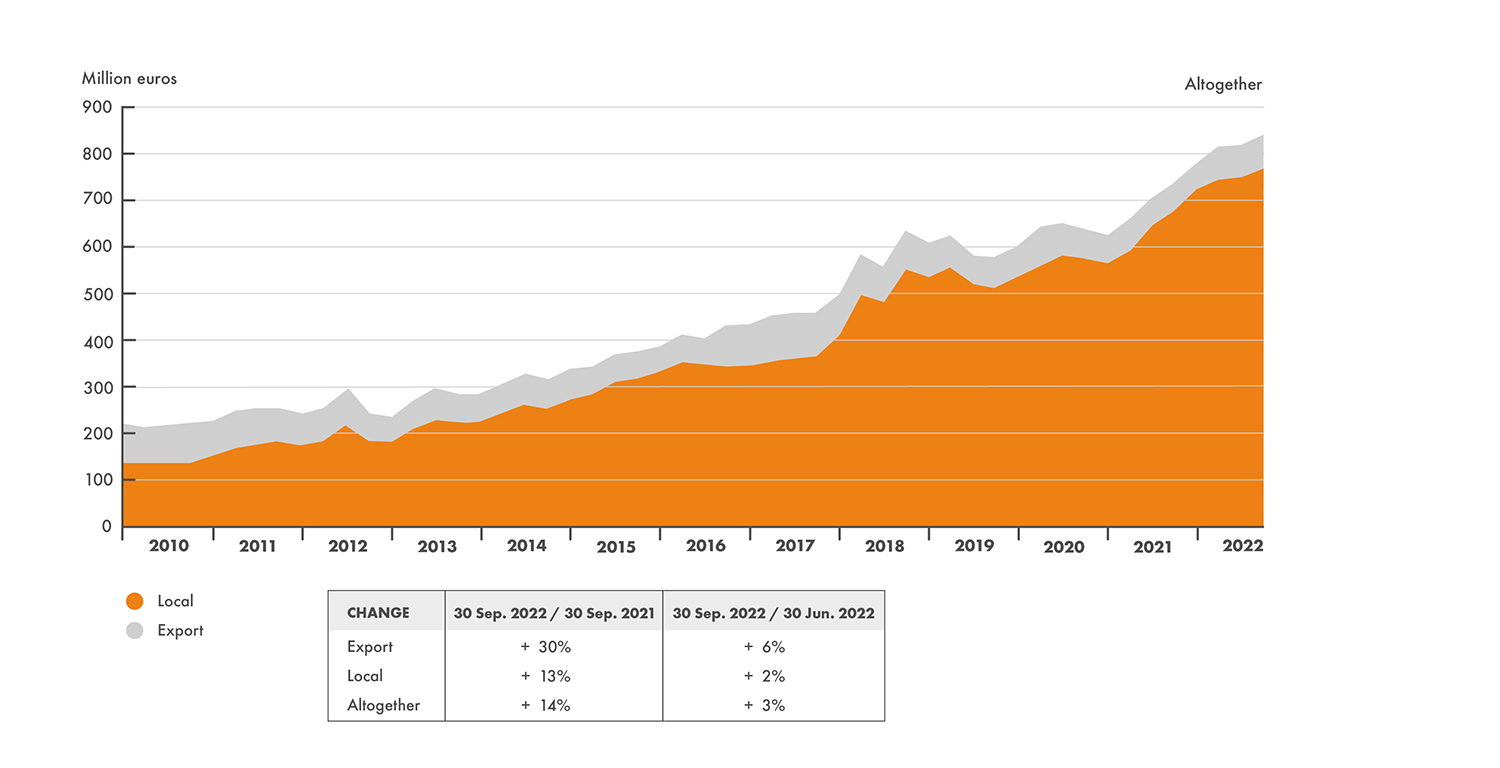

Internationalisation of the design and consulting operations

With regard to the internationalisation of the design and consulting operations, the main investments were made in Sweden, the other Nordic countries and some Eastern European countries. Significant headway was made in Denmark and Norway. In addition, we now operate in the UK. Our export projects were focused on the energy, hospital and data centre sectors.

At the end of 2022, we drew up a strategy for the Swedish market for the next three-year period. Granlund’s core know-how in Sweden is extended especially in terms of energy, hospitals and data centres. Acquisitions play an important role. Our aim is to expand our offering to our existing customers and selectively look for new customer segments. In the other Nordic countries, we are charting the market for a suitable market position for Granlund. As much as possible, we also offer projects that support internationalisation in the longer term.

Granlund Stockholm AB

Granlund Stockholm AB focuses on its four areas of expertise: electricity, energy, lighting and telecommunications design. The company is strong in its areas of operation and it has expanded its know-how through recruitment and training. There are several projects underway, and the company has a wide customer network.

In 2022, the company invested in its areas of special expertise, such as electricity supply, lighting design, solar panel expertise, safety and telecommunications. The project offering has increased to cover new customer segments in terms of both properties, industry and data centres.

Granlund Sweden AB

In 2022, Granlund Sweden AB continued to raise its profile in Sweden. The company was active in organising meetings with customers and joined the Data Center Forum event in Stockholm for the second time with its own stall. Its visibility on the data centre market starts to be at a good level and the company has created some significant new contacts.

The first design project outside Sweden started in 2022. The overall level of know-how has remained strong despite some turnover in personnel. New employees were successfully recruited, and they will strengthen the company’s competence in 2023. This makes it possible to grow the company’s operations.

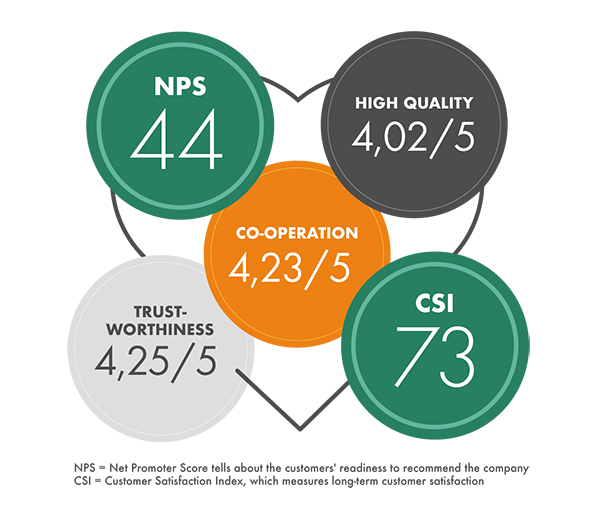

Customer satisfaction

Smooth and seamless cooperation with our customers and stakeholders is of the utmost importance to the development of our operations. That is why we measure and monitor our customers’ satisfaction on a regular basis and respond to development needs as quickly as possible. To measure customer satisfaction, we use long-term surveys and quick pulse surveys. We implement an extensive customer relationship survey every two years and measure our customers’ satisfaction with projects and services on an ongoing basis.

As an expert company, our whole business is based on the expertise, well-being and happiness of our employees. Happy employees also create a solid foundation for the satisfaction of our customers, which is why we continuously invest in internal communications and community spirit.

Top marks for our employees’ expertise

Market research company Taloustutkimus conducted an extensive customer relationship survey for us in the autumn of 2022. Based on the survey, Granlund Group received an NPS (Net Promoter Score) score of 44. The CSI (Customer Satisfaction Index) score measuring long-term customer satisfaction was 73. CSI comprehensively and accurately reflects the percentage of perfectly satisfied customers of all respondents. Generally, our customers consider our company reliable (4.25/5), cooperative (4.23/5) and high quality (4.02/5).

Once again, our employees’ expertise and the accessibility of our contact persons received top marks. Our customer-orientation and the ease of ordering our services were also highly rated. It has been gratifying to see that our ability to respond to urgent assignments has improved from 2020, the last time the survey was conducted. Our ability to deal with issues, which was back then highlighted as a target for development, has also improved. We will continue to pay attention to the matter in the future.

In the autumn of 2022, the targets for development included the activity of communication during projects as well as our experts’ ability to provide customers with new solutions. We will place a special emphasis on these areas in 2023.

The seamlessness of cooperation in projects is improving

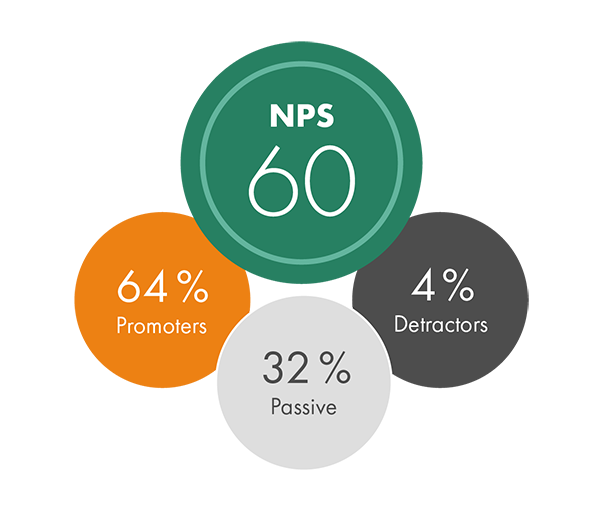

Our operations are largely project-based. Therefore, it is also important to measure customer satisfaction on an ongoing basis. All of Granlund’s companies and areas of business ask for customer feedback at the end of each project or set of projects. Feedback provides us with important information about where the project succeeded and where there is room for improvement.

In 2022, the project feedback NPS figure was 60. 64% of the feedback was positive and 4% of the feedback was negative. Compared with the previous year, the specific areas of improvement included the seamlessness of cooperation and meeting deadlines.

Smooth and seamless cooperation with our customers and stakeholders is of the utmost importance to the development of our operations.

Personnel

In accordance with out strategy, we want to be the best place to work both for our current and future employees. Employee satisfaction and well-being are measured with a comprehensive personnel survey conducted every two years and the monthly Fiilispulssi survey. The previous employee satisfaction survey was carried out in the spring of 2021, and the next one will take place in the autumn of 2023.

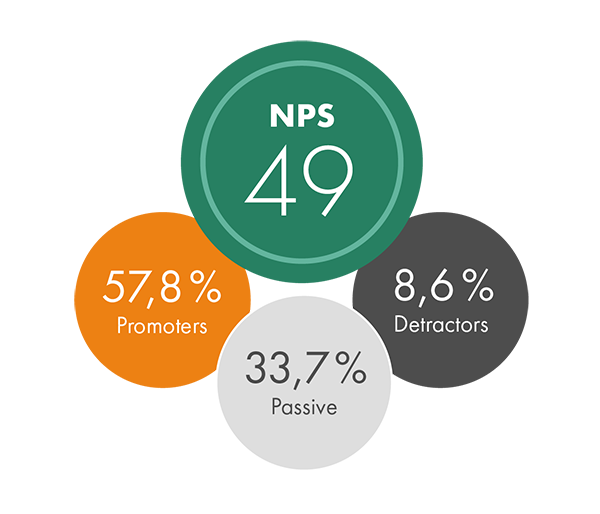

Praise for the work atmosphere

Measured by Fiilispulssi, our employees’ overall satisfaction is high. Granlund’s employees are particularly satisfied with the atmosphere within the work community. The 2022 Fiilispulssi eNPS figure was approximately 49, showing a slight improvement compared to the previous year (45).

Personnel satisfaction is measured on a monthly basis with the Fiilispulssi survey.

New diversity and inclusion work

In 2022, we started our new diversity and inclusion work. One aspect of this was the diversity and inclusion survey carried out among all of our employees. In addition, senior management received training on the subject. According to the survey, it was important to promote both diversity (77%) and inclusion (93%). According to respondents, one of our clear strengths is the sense of belonging to a group.

The majority of respondents were happy with the opportunities to influence things, equal treatment and practices promoting diversity and inclusion. Women as well as ethnic, sexual and gender minorities were somewhat more critical regarding the statements in the survey. Some of the targets of development highlighted in the responses included improving non-Finnish communications channels as well as experiences of inappropriate talk or treatment. The work continues in 2023.

The experience of belonging to a group is Granlund’s strength.

The well-being of personnel

We have invested in the well-being and career progress of our personnel. In 2022, we took measures to improve the well-being of our employees, including:

1. All employees had the chance to take advantage of the Movendos well-being coaching.

2. We made further improvements in the availability of early mediation discussions.

3. We created an operating model that provides employees and their supervisors with the tools to discuss different ways to shape the employee’s way of working. The model is piloted in 2023.

4. Mentoring by coaching: a programme that provides the option for internal mentoring.

5. We remodelled the Granlund Academy learning environment, which includes various contents, courses and learning plans.

6. We started our diversity and inclusion work.

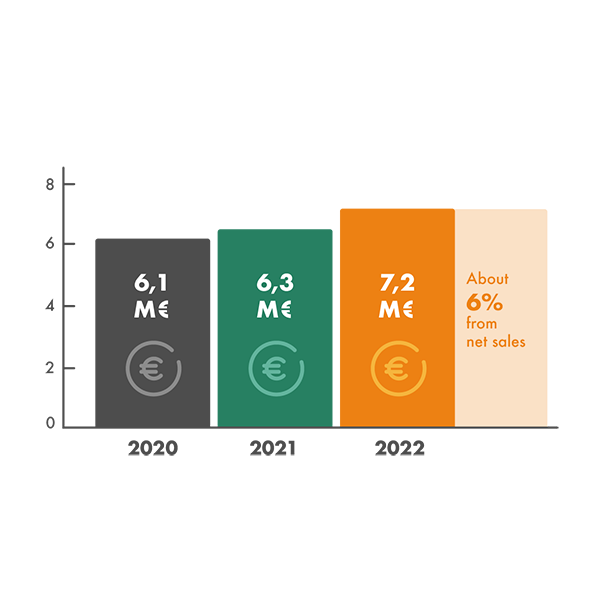

Innovation and development activities

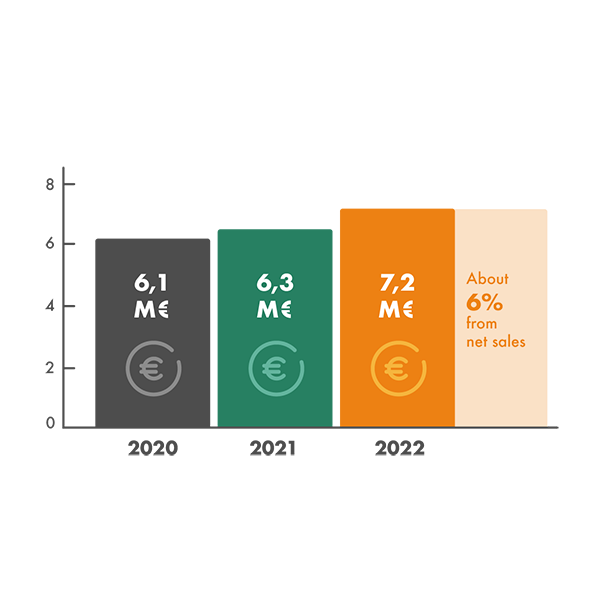

Each year, we invest a significant amount of our net sales in innovation and development activities as well as cooperation with our customers, partner companies, start-ups and research institutes to create new innovations. In 2022, we invested EUR 7.2 million in innovation and development. That equals approximately 10% of the parent company’s net sales and 6% of the whole Group’s net sales.

In 2022, we were involved in many joint development projects involving several international research institutes and companies in addition to Finnish operators. Our aim is to create research, development and innovation networks in order to always get the best research and partner companies for subjects of development. The purpose is to support the special areas determined in our innovation strategy (2021–2026), which also support the implementation of our Plan G strategy.

In the future, the property and construction sector will be shaped by many mega trends, such as climate change, digitalisation and urbanisation. The change creates an opportunity for new innovations, and we have a long history of developing new innovations. This provides us with a great foundation for creating new services and solutions for future needs.

In the future, the property and construction sector will be shaped by many mega trends, such as climate change, digitalisation and urbanisation.

Mad@Work – ITEA3 project

Mad@Work or the Mental Wellbeing Management and Productivity Boosting in the Workplace project involved a Finnish consortium as well as a wide range of international players.

The project is piloted at the Vaasa Central Hospital, where the goal is to smartly identify potential deviations in conditions and their effects.

E3

Excellence in pandemic response and enterprise solutions ecosystem is a project aimed at developing pandemic-safe solutions for the urban environment in collaboration with several research institutes. E3 is Granlund’s biggest development project and one of Business Finland’s biggest development projects. Our role is to coordinate the development of healthcare solutions for the “Smart Modular Healthcare” use case.

Smart hospital

The Smart hospital project promotes the globalisation of our hospital business together with the Integrated Hospital Design Alliance. The project takes a look at the decision-making mechanisms in the target countries with regard to the way designers are chosen for hospital design projects. The goal is also to map hospital design targets and potential partner companies in the fields of architecture, MEP engineering and structural design. In addition, the project investigates the target countries’ legislations and tax practices.

MES-China

The MES-China (Research and Demonstration of Model-based Dispatching of Multi-carrier Energy System in Industrial Parks) project is aimed at developing hybrid energy and digital twin solutions as a collaboration between Finland and China. For the pilot, we chose the Te Xun Cyber Technology Building, which is located in Hangzhou (Zhejiang), China. Our Finnish research partner is LUT University.

DHC-Hybrid

The DHC-Hybrid (Research and demonstration of key technologies of the DHC hybrid system based on a renewable energy heat pump) project is aimed at developing hybrid energy solutions that utilise renewable energy sources as a collaboration between Finland and China. Our Finnish research partner is Aalto University, which carries out research at a doctoral thesis level into solutions based on energy recycling in particular.

IML4E

The ITEA IML4E (Industrial machine learning for enterprises) project develops a process to utilise AI jointly with an international consortium. The project also develops AI-based use cases and services, supporting our strategic “Data flow” development area. Our research partners include the University of Helsinki in Finland and the Fraunhofer Institute in Germany.

Business Finland projects starting in 2023

GenerIoT

GenerIoT (Generating and Deploying Lightweight, Secure and Zero-overhead Software for Multipurpose IoT Devices) is an ITEA project carried out jointly with an international consortium, which is aimed at developing efficient ways to connect IoT devices to geographically scattered infrastructures, such as wind farms and mobile base stations. The project also develops smart services for the long-term monitoring of structures. Our Finnish research partner is Tampere University, and our key international corporate partner is Max Bögl Group, a German company that specialises in wind power.

Smart Grid 2.0

The Next generation distribution grid project develops know-how and new data to connect renewable energy with an electrical grid in conjunction with smart load management and distribution grid capacity management.

The extensive Finnish consortium received financing from Business Finland. In the project, Granlund finances and monitors research by Aalto University.

We also finance the following projects

- Aalto University’s Building 2030 project (new and more efficient operating models for the construction industry)

- Aalto University’s doctoral degrees in smart building engineering

- Metropolia University of Applied Sciences’ Minno innovation projects for students

- Tampere University and Aalto University’s MEP 2030 (Talotekniikka 2030) project

- Tampere University’s Hybrid Energy Solutions (HybE) project 2022–2026

- Tampere University’s industry professorship, building services

- The RAIN2 and RAIN3 projects of companies operating in the construction industry (integration ability and cooperation in construction)

- VTT’s Metaverse project

Established in 2022 on the premise of the Building 2030 project, MEP 2030 (Talotekniikka 2030) is a programme aimed at developing MEP engineering. The project is implemented in cooperation with Aalto University, Tampere University as well as 14 companies, organisations and foundations operating in the sector.

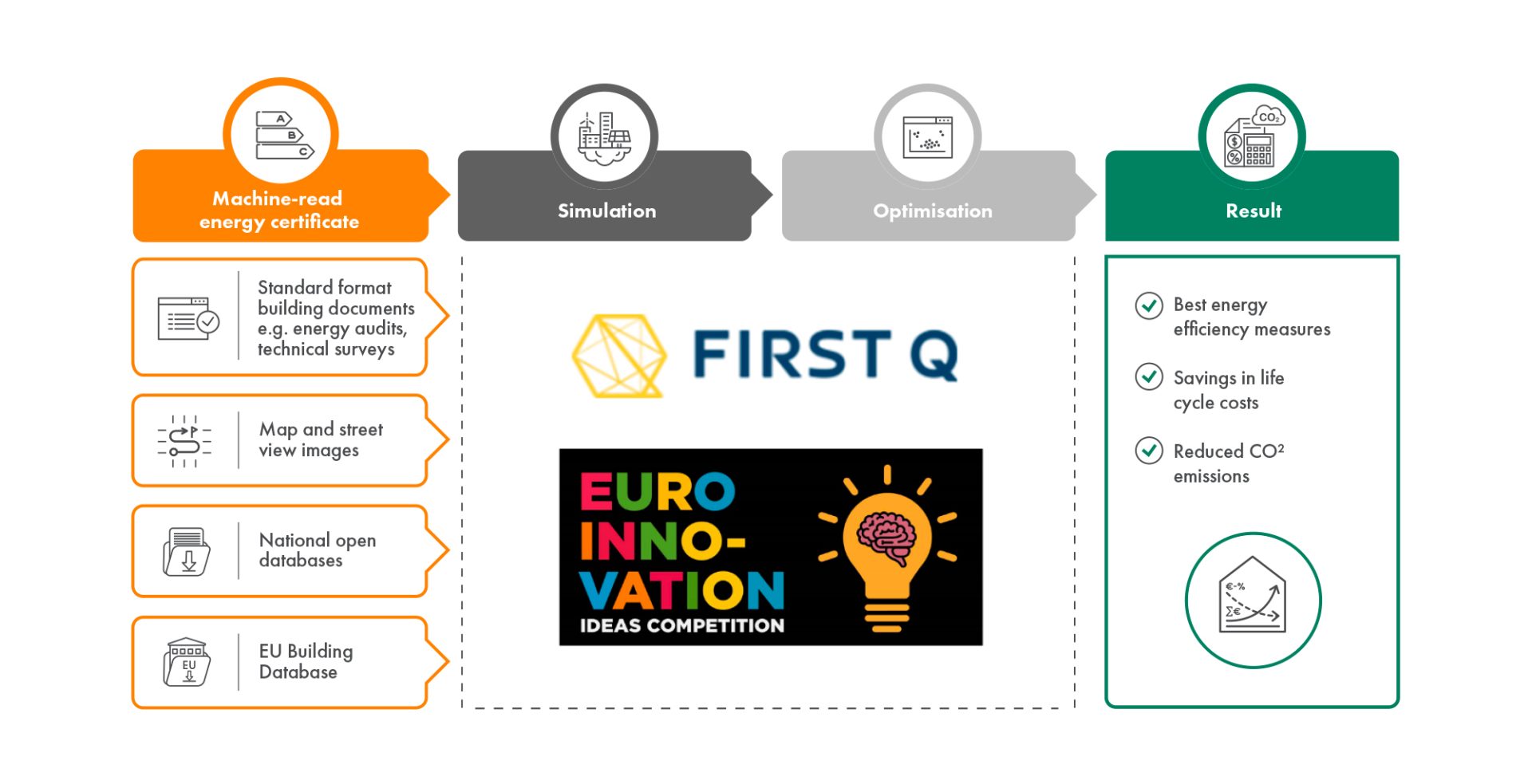

FirstQ Euroinnovation

We came fourth in the Euro innovation competition organised by the FirstQ network. Our proposal was related to surveying the energy-efficiency potential of properties. The work made use of open information sources as well as computer vision-read construction information in maps and street views.

Outlook for 2023

As in many other sectors, the economic situation in the real estate and construction industry at the start of 2023 is very difficult to predict. COVID-19 concerns have been replaced with concerns regarding the war in Ukraine, the challenging inflation trend and rising interest rates. There are very few positive indicators, and the predictions range from a slight economic downturn to recession.

In all probability, the real estate and construction consulting market will see disruptions in 2023. The backdrop to this is long-term growth, active operations on the stock and capital investment market as well as hyper valuations. It remains to be seen whether the changes become significant factors with regard to the development of the market. The effects may be restricted to changes in ownership.

Competition between expert companies will be fiercer than in the previous years. Growth will be visible in fewer segments. Regardless, companies operating in sectors that are less dependent on economic trends which are ready to actively contribute to the green transition are likelier to do better.

Using our strengths to get through a tough period

Would you like discuss the topics in more detail?

Pekka Metsi

Miia Anttila

Jukka Tyni

Sirpa Sinkkonen

Topi Volama

Kimmo Mattila

Tapani Muttonen

Jari Innanen

Heikki Ihasalo

Jukka Vasara

Timo Ranne

Maila Herva

Risto Havo

Molli Nyman

Minna Lappalainen

Vikke Niskanen

Susanna Sairanen

Juho Lepistö

Teemu Salonen

Granlund’s previous annual reports

Tilaa uutiskirjeemme

Kuule ensimmäisten joukossa Granlundin ja KiRa-alan uutisista ja uusimmista trendeistä.